The Aluminum Can Shortage: How to Avoid Being Crushed has created significant challenges for the beverage industry. In 2021, demand for aluminum cans surged by over 7%, but factories struggled to produce enough to meet this increase. Rising energy prices led some smelters to reduce aluminum output, driving up costs and making it harder to secure sufficient supplies. According to Ball Corporation, there were 10 billion fewer cans available than needed. As a result, companies had to cut back on the variety of drinks they offered and turn to alternative packaging options. Both large and small beverage brands now face empty shelves and must adapt their product offerings to survive The Aluminum Can Shortage: How to Avoid Being Crushed.

Key Takeaways

Causes of the Shortage

![Causes of the Shortage]()

Energy Prices and Smelter Cuts

Making aluminum needs a lot of electricity. When energy prices go up, it costs more to make aluminum. In the last few years, energy prices rose a lot in Europe and Asia. This made many smelters slow down or close. For example, in 2022, European aluminum makers cut their output by 25% because natural gas was expensive. China also had to cut production because of energy limits and higher coal prices. These changes meant less aluminum was made worldwide. Beverage companies then had trouble getting enough cans.

Experts say electricity is about 30% of the cost to make aluminum. When power gets expensive, smelters cannot keep up. In North America, there were 33 main smelters in 1980. Now, there are only 6 left. Power in Europe now costs almost twice as much as in the U.S. This makes it even harder for smelters to stay open.

Here is a table that shows how energy costs and aluminum production changed:

Year | Average Energy Cost (USD per MWh) | Global Aluminum Production (Million Metric Tons) |

2022 | 85 | 68 |

2023 | 93 | 69 |

2024 | 101 | 70 |

2025* | 110 (Projected) | 72 (Projected) |

Source: International Energy Agency, 2024; International Aluminum Institute, 2024.

Numbers show that aluminum production in western and central Europe dropped by 13.2% in April 2022 compared to last year. This happened mostly because the war in Ukraine made energy prices jump. Some smelters, like Norsk Hydro in Slovakia, closed down. This made the can shortage worse. With fewer smelters working, there were fewer cans. Prices went up and shortages spread in North America and other places.

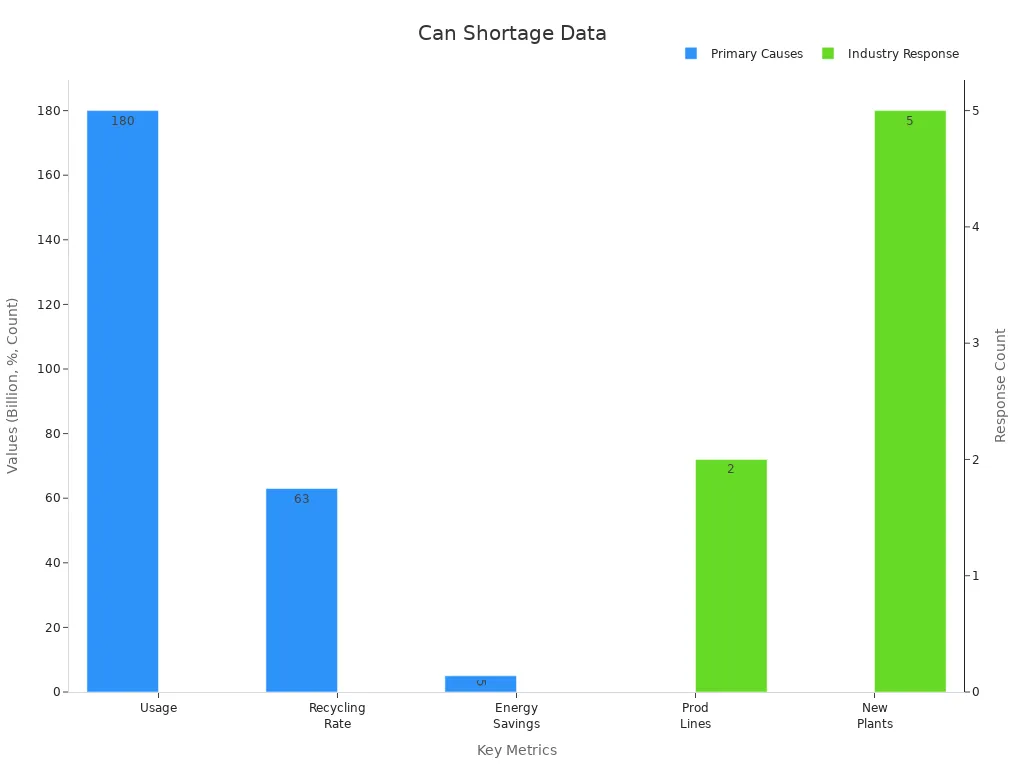

Pandemic Shifts in Demand

COVID-19 changed how people bought drinks. Lockdowns kept people at home. They bought more canned drinks to keep at home. This made demand for cans go way up, especially for beer and soft drinks. In five weeks early in the pandemic, spirit sales went up 47%, wine sales went up 37%, and beer sales went up 33%. Online beer sales more than doubled in March and April. Grocery delivery app downloads jumped by 218% each day.

Consumer Behavior Shift | Statistic/Trend |

Spirit sales increase | Up 47% during a five-week period |

Wine sales increase | Up 37% during a five-week period |

Beer sales increase | Up 33% during a five-week period |

Online beer sales | Over 100% increase in March and April |

Grocery delivery app downloads | Surge up to 218% daily downloads |

Bulk buying and non-perishable food purchases | Significant increase during early pandemic |

Frozen food purchases | Increased notably |

Breakfast-related purchases (pancake mix, syrup) | Up 245% over six weeks |

Hot cereal purchases | Up 177% over six weeks |

Breakfast meat purchases | Over 100% increase over six weeks |

![Bar chart showing consumer behavior shifts during COVID]()

These numbers show people wanted easy, long-lasting drinks and foods. Because of this, beverage companies ran out of cans and had to change fast to meet new needs.

Rise of Canned Beverages

Canned drinks have become much more popular lately. People like drinks that are easy to carry and store. Aluminum cans are handy and keep drinks fresh. Hard seltzers, craft beers, and ready-to-drink cocktails helped this trend grow. Hard seltzers made up 91.7% of canned alcoholic drinks in 2022. Ready-to-drink cocktails are growing by 14% each year. Craft beer makers like cans because they keep beer safe from light and air.

The world market for aluminum cans is growing because more people want energy drinks, seltzers, and canned cocktails.

Many people pick aluminum cans because they are easy to carry and better for the planet.

Craft beer makers use cans to keep their drinks fresh and safe.

Beverage companies make new drinks, like Molson Coors' Vizzy hard seltzer and Pernod Ricard's Jameson RTD cocktail, to match what people want.

Aluminum cans are good for the environment because they can be recycled many times without losing quality. This is important to people and companies who care about the planet. But, the fast growth in canned drinks has made the can shortage worse, especially for small companies who cannot get as many cans as big brands.

The Aluminum Can Shortage: How to Avoid Being Crushed

Supply Chain Disruptions

Manufacturing Bottlenecks

Factories that make cans have many issues. They cannot make enough cans because of not enough workers and broken machines. Factories can only make a lot of cans if everything works right. But, breaks and repairs mean they make less. Sometimes, machines break or workers do not show up. This makes even fewer cans. Small factories have a harder time with these problems. They cannot fill orders when things go wrong. Some factories use AI to guess when machines might break. This helps them fix things faster and make more cans.

Transportation and Logistics Challenges

Getting cans and materials to drink companies is tough. Trucks and ships are often late. Ports get crowded and shipping costs more money. During the pandemic, rules slowed down bauxite mining and recycling. This made it harder to get aluminum for cans. Not enough truck drivers and ship workers made things worse. Companies watch their suppliers closely and use different shipping partners. This helps them avoid late deliveries.

Impact on Small vs. Large Producers

Small drink companies have bigger problems with the aluminum can shortage: how to avoid being crushed. Big brands can get more cans because they have more power. Small companies get fewer cans and pay more money. They might run out of cans and lose sales. To keep going, small companies need good supplier relationships and backup plans.

Tip: Companies can lower risks by using more suppliers and better inventory tracking.

Global Production Limits

Standard Can Size Shortages

Popular can sizes like 12-ounce and 16-ounce are hard to find. Factories cannot make enough of these sizes. Drink companies sometimes cannot get the right cans. They may need to use other sizes or change their packaging.

Can Lid Availability

There are not enough lids for cans either. Without lids, companies cannot sell new or special drinks. This means fewer choices for shoppers and slower new product launches.

Sourcing Alternatives and Flexibility

To deal with the aluminum can shortage: how to avoid being crushed, companies try new ideas. They use different can sizes, new lid types, or other packages. Flexible machines help them switch fast. Working with many suppliers and talking often helps them handle shortages.

Note: Good inventory planning and talking with suppliers helps companies survive the aluminum can shortage: how to avoid being crushed.

Industry Impacts

![Industry Impacts]()

Effects on Beverage Companies

Big beverage companies have more power in the market. They usually get cans first when there are not enough. These companies can make long deals with suppliers. This helps them keep their drinks in stores during shortages. They can also pay more for cans if they need to. Their good supplier relationships help them a lot.

Small companies do not have as much power. They might have empty shelves or wait to sell new drinks. Some brands offer fewer flavors or sizes. This lets them focus on their top drinks and handle less supply. If companies cannot get enough cans, they lose sales. The beer can shortage makes it tough for new brands to start. Many companies have slower sales growth because they cannot meet demand.

Note: Beverage companies that plan ahead and talk to suppliers can lower the chance of running out of cans.

Challenges for Small Producers

Small brewers and craft soda makers have the hardest time. They order fewer cans at once. Suppliers may skip small orders when demand is high. Big brewers get most of the cans. Small producers pay more or wait longer for cans. This hurts their sales and makes business hard.

Some small brewers use bottles or different can sizes. Others wait to release new drinks. They may also spend less on ads because they cannot get enough cans. Many small producers depend on local buyers. If they cannot get cans, they lose sales to big brands. The can shortage has made some small brewers close or join bigger companies.

Challenge | Impact on Small Producers |

Limited can supply | Delayed product launches |

Higher can prices | Lower profit margins |

Priority to large brands | Reduced access to cans |

Unpredictable deliveries | Missed sales opportunities |

Tip: Small brewers can do better by using more suppliers and keeping extra cans when they can.

Shift from Bottles to Cans

The drink industry is moving from bottles to aluminum cans. This change happens for many reasons:

Aluminum cans are easy to recycle and better for the planet.

Many people want packaging that is easy to carry and keeps drinks fresh.

Busy cities and fast lives make people want single-serve drinks.

Aluminum cans keep drinks safe from light and air, so they stay fresh.

New can designs help drinks stand out in stores.

Brands and governments want less plastic waste, so they pick cans.

Cans are lighter than glass, so shipping and storing costs less.

The world market for aluminum cans keeps growing. Experts think it will go from $63.2 billion in 2025 to $94.5 billion in 2035. This growth comes from the need for green, light, and recyclable packaging. People in many places like cans for beer and soda. Aluminum cans also keep bubbles in drinks better than other packages.

Blockquote: "Aluminum cans are now the top choice for many beverage brands. Their convenience, recyclability, and ability to keep drinks fresh have made them a favorite among both companies and consumers."

More brands want cans, so demand is higher during the shortage. As more companies stop using bottles, more cans are needed. If there are not enough cans, companies may sell fewer products or change their packaging. This means less choice in stores and lost sales.

Adapting to the Aluminum Can Shortage

Alternative Packaging

Beverage companies are trying new packaging ideas. They want to use less aluminum beverage packaging. Many brands now use glass bottles or cartons. Some even try new materials like cellulose-based or edible packaging. A big review of sustainable packaging shows some cool options. Seaweed-based edible wraps and biodegradable packing peanuts can help with supply chain problems. These choices also help the planet. For example, a bakery start-up in India used bio-pouches and recycled cardboard boxes when cans were hard to find. This switch helped the company make 20% more money in 2021 and 32% more in 2022. But experts say companies must think about food safety and waste. Studies show reusable packaging for perishable drinks needs more research. This is to stop more food waste. Beverage brands that try new packaging can be stronger and depend less on aluminum cans.

Importing Aluminum

Some beverage companies bring in aluminum from other places. This helps when local smelters cannot make enough. The table below shows how different choices change aluminum supply and the environment:

Metric | Scenario A (No restrictions) | Scenario B (Moderate reduction) | Scenario C (Enhanced reduction) |

Peak Aluminum Demand (MT) | 70 (2025) | 60 (2025) | 52 (2020) |

Primary Aluminum Production (MT) | 52 (2025) | 40–43 (2020–2025) | 39 (2020), 14 (2030) |

Proportion of Recycled Aluminum (%) | ~38 (2030) | N/A | 55 (2030) |

Using more recycled aluminum is better for the earth. Recycling uses less water and energy than making new metal. It also makes less greenhouse gas. Beverage companies that recycle and import greener aluminum can meet demand and help the planet.

Communication with Consumers

Talking clearly with customers helps during shortages. Studies show only 7% of stores update customers about shipping. This leaves many people in the dark. Telling customers what is happening builds trust. It also makes people less worried. Companies that send updates and shipping notices make customers happier. They also get fewer calls and returns. Real-time tracking and updates keep everyone on the same page. This makes customers more satisfied and helps business. When brands explain changes in packaging or products, people understand why. Good communication keeps customers loyal and coming back.

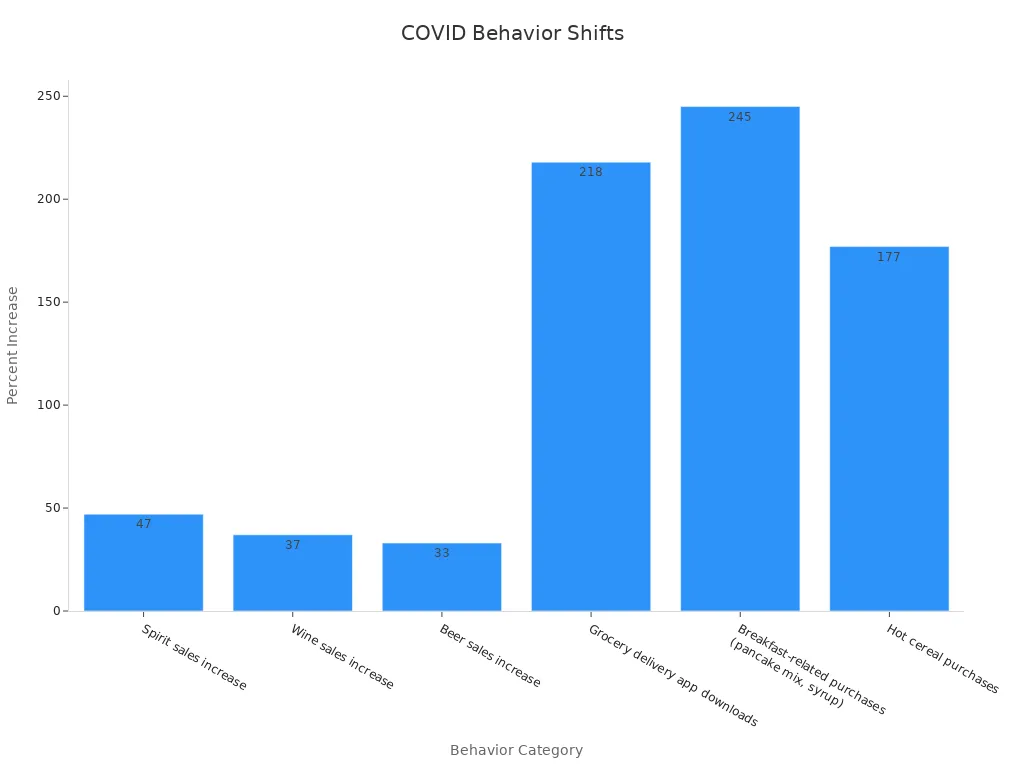

The aluminum can shortage happens because people want more cans, energy costs are high, and the pandemic changed how people buy drinks. Beverage companies must make hard choices. They look for new suppliers and try different packaging. Every year, people use over 180 billion cans. About 60-66% of these cans get recycled. Recycling saves energy and helps with the shortage. Ball Corporation built new factories to make more cans. Some brands sell less, and others lose sales. Industry leaders think the shortage will get better as recycling and production increase.

Aspect | Data / Description | Implication / Industry Response |

Annual aluminum can usage | Over 180 billion cans used yearly | Indicates very high demand contributing to shortage |

Recycling rate | Approximately 60-66% of cans recycled | Recycling reduces energy use and supply pressure |

Energy savings from recycling | Recycling uses less than 5% of energy compared to producing new aluminum | Emphasizes importance of recycling to alleviate shortage |

Demand drivers | COVID-19 pandemic increased canned beverage demand due to bar/restaurant closures and hard seltzer popularity | Explains surge in demand causing shortage |

Industry response | Ball Corporation installing 2 new production lines and building 5 new plants | Shows active expansion to meet demand |

Recycling infrastructure | Increased investment in recycling emphasized | Supports sustainable supply and reduces reliance on new aluminum |

![Bar chart showing aluminum can usage, recycling rate, energy savings, and industry response figures.]()

Tip: Companies that spend money on recycling and have flexible supply chains can keep selling drinks and meet future needs.

FAQ

What caused the aluminum can shortage?

There are many reasons for the shortage. Energy prices went up, so some smelters closed. The pandemic changed how people bought drinks. More people wanted canned drinks fast. Factories could not make enough cans.

Note: When demand is high and supply is low, shortages happen.

How does the shortage affect beverage companies?

Big companies get more cans because they have good supplier deals. Small producers have trouble finding enough cans. Some brands sell fewer flavors or sizes. Many companies lose sales if they cannot get enough cans.

Are there alternatives to aluminum cans?

Yes, there are other choices. Companies use glass bottles, cartons, or biodegradable packaging. Some brands try new things like seaweed-based wraps. These options help companies use less aluminum.

Packaging Type | Example Use |

Glass bottles | Craft sodas |

Cartons | Juices, milk |

Biodegradable wraps | Specialty drinks |

Will the aluminum can shortage end soon?

Experts think the shortage will get better as new factories open. More recycling also helps. Companies are spending money on more production and better supply chains. How fast things improve depends on energy prices and world demand.

How can consumers help during the shortage?

People can recycle cans and try drinks in other packages. They can buy from local brands that use different packaging. Recycling cans saves energy and helps the supply chain.

Tip: Recycling every can helps the planet and the drink industry.